The Basics

No, there are no out-of-pocket expenses after your initial purchase. The price of a share includes a prepaid amount designated for the care and training of the horse. To ensure the training and maintenance account remains adequately funded, a portion of race earnings is allocated to replenish the reserve account as needed.

In the event that the reserve account is depleted, our parent company, Experiential Squared (E2), may provide a loan to cover expenses. Any funds loaned by E2 will be repaid using future purse earnings or sales revenue. If, at the time of the horse’s closure, the account remains negative, the outstanding debt will be forgiven.

Additionally, if further funding is required, MyRacehorse has the option to issue additional shares at the prevailing market price. Our goal is to ensure that owners can focus on the experience while we manage the financial aspects of the horse’s care and training.

Yes! Your horse’s ownership company is a for-profit entity. If the horse is ultimately profitable—meaning its earnings exceed the costs of purchase, training, maintenance, and other operational expenses—you may receive a dividend. However, there is no guarantee of profitability, as many racehorses do not generate a profit. That said, when a horse does succeed, the rewards can be significant. Examples of highly successful MyRacehorse runners include Seize the Grey and Straight No Chaser, who have delivered strong financial returns.

Beyond potential earnings, we believe the ownership experience itself provides immense value. From behind-the-scenes content to exclusive race-day experiences, MyRacehorse offers a level of engagement that goes beyond traditional investing. We often compare the cost of a share to a concert ticket—except instead of a single event, MyRacehorse ownership can provide months or even years of excitement, making the experience truly priceless.

Investing in a racehorse comes with inherent risks. Horses are living, breathing athletes, and their performance, health, and overall success can be unpredictable. There are no guarantees of profitability—most racehorses do not generate a return, some may break even, and only a select few become highly profitable.

At MyRacehorse, we provide a secure and transparent marketplace to make racehorse ownership accessible, enjoyable, and engaging. However, it’s important to understand that while we enhance the experience with exclusive content and behind-the-scenes access, we do not remove the financial risks associated with racehorse ownership. The thrill of being part of a horse’s journey—through training, race days, and potential victories—is a core part of the MyRacehorse experience.

Owning a micro share through MyRacehorse allows you to experience the thrill of racehorse ownership without the high costs and responsibilities traditionally associated with it. Some key benefits include:

— Affordable Access to Racehorse Ownership –MyRacehorse makes it possible to own a share in a top-quality thoroughbred for a fraction of the cost of full ownership with a one time out-of-pocket fee.

— No Ongoing Expenses – After your initial purchase, there are no out-of-pocket costs for training, care, or management.

— Exclusive Ownership Experience – Gain behind-the-scenes access, including training updates, race insights, and expert analysis from industry professionals.

— VIP Race Day Access – Attend races as an owner, enjoy exclusive hospitality events, and celebrate your horse’s journey alongside fellow shareholders.

— Transparency & Security – Our platform provides a secure and regulated way to participate in racehorse ownership, ensuring clear communication and fair management.

— Potential for Financial Returns – While there are no guarantees in horse racing, successful horses can generate purse earnings or future sales revenue, which may result in dividends for owners.

— Unmatched Excitement & Community – Join a passionate community of racing fans and experience the emotional highs of watching your horse compete at premier tracks.

MyRacehorse offers an experience that goes beyond financial investment—it’s about the thrill, the memories, and the pride of being part of a horse’s journey from the starting gate to the winner’s circle!

When you click the “Indicate Interest” button, you’re securing your spot on our early access mailing list for an upcoming offering. This means you’ll be among the first to know and have access before the offering is made available to the public, giving you a head start on purchasing shares.

Emails are sent out in waves, starting with those who indicated interest earliest. The sooner you click “Indicate Interest,” the better your chances of securing a share before they sell out. While indicating interest does not guarantee availability, it ensures you stay informed and have priority access when shares become available.

Product Types

As MyRacehorse continues to grow and expand we’ve had a large number of shareholders express interest in different types of ownership opportunities. As a result, in addition to our core micro-share offerings (Reg A and Reg CF), we now have MyRacehorse Syndicate Shares (Reg A and Reg CF) which are smaller ownership groups. Additionally, our Edge program is for accredited investors (Reg D) who would like to invest a significant amount into one offering.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Buying Shares

Anyone US citizen over the age of 18 from a qualifying jurisdiction and with a verified MyRacehorse account can purchase shares. Click here to set up your MyRacehorse account if you do not already have one.

An accredited investor is someone who meets specific financial criteria set by the U.S. Securities and Exchange Commission (SEC). You are considered an accredited investor if you meet at least one of the following requirements:

— Income Requirement: Earned $200,000 individually (or $300,000 jointly with a spouse/partner) in each of the last two years and expect the same for the current year.

— Net Worth Requirement: Have a net worth of over $1 million, excluding the value of your primary residence.

— Professional Certification: Hold specific financial credentials such as a Series 7, Series 65, or Series 82 license.

If you do not meet any of these criteria, you are considered a non-accredited investor and can still participate in MyRacehorse’s Reg A and Reg CF micro-share offerings, which are open to all investors.

For those who qualify as accredited investors, Edge Advantage (Reg D) offers exclusive access to premium investment opportunities. If you’re unsure of your status, we recommend consulting with a financial advisor or reviewing the SEC guidelines here.

Your net worth is calculated by subtracting your total liabilities (debts) from your total assets (everything you own).

Formula:

Net Worth = Total Assets – Total Liabilities

Step 1: Calculate Your Total Assets

Include the value of the following:

– Cash (checking and savings accounts)

– Investments (stocks, bonds, mutual funds, retirement accounts)

– Real estate (excluding your primary residence for accreditation purposes)

– Business ownership or equity

– Other valuable assets (art, jewelry, vehicles, etc.)

Step 2: Calculate Your Total Liabilities

Include any outstanding debts, such as:

– Mortgages (excluding primary residence for accreditation purposes)

– Car loans

– Student loans

– Credit card debt

– Personal loans

Example Calculation:

~ Total Assets: $2,000,000

~Total Liabilities: $800,000

~Net Worth = $2,000,000 – $800,000 = $1,200,000

For accreditation purposes, the value of your primary residence is excluded from this calculation. If you’re unsure about your net worth, consider consulting a financial professional.

Most of our qualified offerings are listed on the Buy Page, where you can browse and invest in available racehorses.

In some cases, a horse may be temporarily removed from the Buy Page due to an injury. If this happens, we prioritize the horse’s recovery and will relist it once it has healed and returned to training.

We encourage you to check back regularly, as new offerings become available, and horses may return to the marketplace once they are back in training.

No, each MyRacehorse account must be registered under a single name, as this name is used to report payouts to the IRS at the end of the year. To ensure compliance, we are unable to accommodate multiple names on a single account.

However, you’re more than welcome to share your ownership experience with friends and family!

Due to securities regulations, shares cannot be purchased in someone else’s name, however, MyRacehorse does offer gift cards. Please note individuals must have a verified account before being able to purchase or have shares transferred into their account. Click here to create an account. For questions regarding transferring shares, please see below.

We are constantly looking to streamline and improve the process transferring shares. For the most up to date information about the transfer process, or to submit a transfer request, click here. For information about transferring shares as part of an inheritance, click here.

Yes, if there are still shares available and you haven’t hit our investment cap, you’re welcome to purchase additional shares.

There is no minimum for any type of offering.

Under Regulation A, investment limits vary based on whether you are an accredited or non-accredited investor:

Accredited Investors: There are no investment limits for accredited investors in Regulation A offerings.

Non-Accredited Investors: For Tier 2 Regulation A offerings, non-accredited investors cannot invest more than 10% of the greater of their annual income or net worth per offering. Tier 1 Regulation A offerings do not have investment limits.

Since MyRacehorse offerings typically fall under Tier 2, non-accredited investors will be prompted before checkout to certify that their investment falls within these regulatory limits.

For more information on accredited investor status and investment caps, please review the SEC guidelines.

For Reg CF offerings: As a starting point, anyone can invest up to $2,500, or 5% of your net worth or annual income (whichever is greater) within a 12 month period. This applies to all Reg CF investments – not just the ones made with MyRacehorse.

If your net worth and annual income are both over $124,000, you can invest up to 10% of your net worth or annual income.

If you’d like to invest over $124,000 in Reg CF offerings, we’ll need some financial documentation on file before we can accept those investments.

If you’re accredited, there’s no limit. If you’d like to verify that you’re accredited, you can schedule a meeting with a member of our team. To become accredited, investors must have a net worth of $1,000,000 or more, or an annual income of $200,000 ($300,000 with a spouse or domestic partner.) To check to see if you qualify MyRacehorse partnered with a 3rd party verification firm Investready which can verify your accredited investor status online. Please follow this link which will walk you through the verification process and should take 5-10 minutes to complete. You will be required to set up an account and walk through a series of suitability questions and then upload certain specific documents (W-2, 1099s, Broker or bank statements etc)

To ensure fair access and broaden participation, MyRacehorse has implemented a standard 1% share cap per person during the early access period. This means no single investor can purchase more than 1% of the total available shares while early access is active.

Once the early access period ends, the cap increases, allowing individuals to acquire up to 2.99% of the available shares in a given horse or offering.

In certain high-profile offerings with limited inventory, MyRacehorse reserves the right to apply a fixed-share limit rather than a percentage-based cap. This approach helps distribute ownership more widely, ensuring more investors have the opportunity to participate.

Our mission is to make elite racehorse ownership accessible to everyone, bringing more individuals into the sport at the highest level. Implementing a share cap allows us to expand access and engagement among a larger community of owners.

For more details on investment caps, please see above.

If one of our horses is about to race and shares are still available, we’ll take the listing down at post time. Once the race is over, our team will review the race results and check in with the trainer to confirm that the horse came out of the race in good standing.

If a horse is scheduled to race and shares are still available, we will temporarily remove the listing at post time. This allows our team to evaluate the horse’s performance, review race results, and check in with the trainer to ensure the horse has come out of the race in good condition.

Once the race has been assessed:

If the initial valuation remains fair, shares will be relisted at the same price within a few days.

If the race significantly impacts the horse’s valuation, we may discontinue the offering at the original price. In some cases, our management team may explore relisting shares at a new price, which would require SEC qualification before becoming available for purchase.

This process ensures that our offerings reflect the most accurate and fair valuation of each horse while prioritizing the well-being of our equine athletes.

There are five parts to an offering as fully described in the offering circular, for a summary of the five key components see below:

Asset Cost– Includes the initial purchase price of the horse plus any sales or use taxes, and the associated bloodstock fee.

Operating Reserve Account– The portions of the proceeds that are used to fund the ongoing expenses of the series. These expenses generally include training and care costs, mortality insurance, veterinary, administrative, audit, taxes, transportation, race nomination/entry/starter costs and registration costs.

Brokerage Fee – Each offering has been qualified by the Securities and Exchange Commission (SEC) and is offered through a registered broker-dealer, Dalmore Group, LLC a member of FINRA and SIPC.

Management and Due Diligence – Due Diligence covers the expenses for the discovery of the underlying asset and the establishment of the series. The Management fee is for the active management of the series by working with the stakeholders including trainers, vets, bloodstock agents, track reps, finance, legal, insurance brokers and compliance advisors to maximize the performance of the series. No additional management fees will be incurred unless the management performance bonus or sales commission is earned.

Organizational & Experiential – Organizational expenses that are covered include key essential services including legal, compliance, marketing, and establishment of the financial and corporate framework in connection with an Offering of a Series of Interests. The Experiential fee covers the Management of the Membership Experience Program, which includes, but is not limited to content development, management of race day ownership perks, and access to the MyRacehorse Platform™.

MyRacehorse has updated its performance-based compensation model to better align with shareholder interests.

For offerings qualified before May 6, 2022: The manager earned 10% of all gross earnings, including race winnings.

For offerings qualified after May 6, 2022: The manager now earns 10% of gross earnings from stakes races only, meaning earnings from non-stakes races are not subject to management fees.

Additionally, the manager has adjusted its compensation on final sales proceeds for offerings qualified after May 6th 2022:

If the horse does not appreciate in value, the manager’s share of final sale proceeds has been reduced from 10% to 5%.

If the horse sells for more than its initial purchase price, the manager will earn a 20% bonus on the net gain (the difference between the selling price and the initial purchase price).

These changes ensure that MyRacehorse’s management is incentivized to maximize value and success for shareholders while maintaining fair compensation structures.

Yes, you can designate a beneficiary for your MyRacehorse shares. Currently, the best way to do this is by including your shares in your will or estate planning documents.

We recognize the importance of providing a streamlined process for naming beneficiaries and are actively working on updates to the MyRacehorse app and website that will allow owners to designate a beneficiary directly through their account page.

There are never any mark-ups on the horse, you pay exactly what we pay for the horse. There are, however, other associated fees such as the Brokerage fee, Management & Due Diligence fees, Organizational & Experiential fees and the performance bonus. A breakdown of each share price including the fees can be found on the buy page for each series.

Brokerage Fee- Each Regulation Crowdfunding (Reg CF) offering is filed with the Securities and Exchange Commission (SEC) via a Form C. Each Regulation A (Reg A) offering is qualified by the SEC. All offerings are conducted through a registered broker-dealer, Dalmore Group, LLC, a member of FINRA and SIPC.

Management & Due Diligence – Due Diligence covers the expenses for the discovery of the underlying asset and the establishment of the series. The Management fee is for the active management of the series by working with the stakeholders including trainers, vets, bloodstock agents, track reps, finance, legal, insurance brokers, and compliance advisors to maximize the performance of the series. No additional management fees will be incurred unless the management performance bonus or sales commission is earned.

Organizational & Experiential – Organizational expenses that are covered include key essential services including legal, compliance, marketing, and establishment of the financial and corporate framework in connection with an Offering of a Series of Interests. The Experiential fee covers the Management of the Membership Experience Program, which includes, but is not limited to content development, management of race day ownership perks, and access to the MyRacehorse Platform™.

When you purchase a share through MyRacehorse, you are acquiring an equity stake in a specific series of a Series Limited Liability Company (LLC) that owns the horse(s). Each horse, or bundle of horses, offered is structured as its own individual series within the LLC, ensuring that your investment is tied directly to that specific horse’s earnings and potential future sale proceeds.

While this structure provides the benefits of racehorse ownership, it is important to note that shares are considered securities, not physical ownership of the horse itself. Each offering is conducted in compliance with securities regulations to ensure transparency and investor protection.

Yes, these are genuine securities issued in compliance with applicable U.S. securities laws. MyRacehorse offerings are structured under one of the following regulatory frameworks:

State Permit Offerings – Registered or approved at the state level, permitting the sale of securities within specific jurisdictions only.

Regulation A (Reg A) – A securities exemption under the Securities Act of 1933 that requires SEC qualification and allows companies to raise capital from both accredited and non-accredited investors across the U.S., subject to offering limits.

Regulation Crowdfunding (Reg CF) – An SEC-regulated exemption that enables companies to raise capital through registered crowdfunding platforms, with limits on the amount companies can raise and how much individuals can invest, depending on income and net worth.

Regulation D (Reg D) – An exemption that permits private offerings of securities to accredited investors, without SEC registration, under specific rules (e.g., Rule 506(b) or 506(c)).

Each offering is conducted in accordance with federal and/or state securities laws and regulations, with the goal of ensuring transparency, regulatory compliance, and investor protection.

No, when you invest through MyRacehorse, you are not purchasing shares in MyRacehorse as a company. MyRacehorse is a manager of the horse companies and handles the offerings. Experiential Squared, Inc. DBA MyRacehorse itself is a separate company from the horse companies. Instead, you are buying equity shares in a specific series of a Series Limited Liability Company (LLC) that owns an individual racehorse.

Each horse offered is structured as its own separate series within the LLC—not to the broader MyRacehorse business operations.

This structure ensures that each horse operates independently while providing investors with a secure and transparent ownership experience.

If your horse’s earnings exceed $10 in a calendar year, you will receive a Form 1099-DIV for that tax year for traditional MyRacehorse offerings. These offerings are designed to make racehorse ownership accessible to the average person—true crowdfunding in action. To help simplify tax reporting, the horse series entities issue 1099s when applicable.

For investments made through our Edge partnership or in MyRacehorse Syndicate shares, investors will receive a Schedule K-1 instead, as those structures are treated as partnerships for tax purposes.

Syndicate Shares are a new ownership model introduced by MyRacehorse, offering a more intimate ownership experience with approximately 150-300 owners per horse. This structure provides enhanced engagement opportunities due to the smaller ownership size. This ownership model is still a one-time out of pocket payment and open to both non- accredited and accredited investors.

Syndicate Shares are offered through Regulation A or Regulation Crowdfunding, making them accessible to both accredited and non-accredited investors. They involve a one-time, upfront payment with an ownership group of approximately 300 investors per horse.

In contrast, Edge Racing operates under a Regulation D offering, which is exclusively available to accredited investors. This structure involves a smaller ownership group of around 40-60 partners and requires ongoing quarterly contributions to cover training and care expenses.

No, there are no out-of-pocket expenses after your initial purchase. The price of a share includes a prepaid amount designated for the care and training of the horse. To ensure the training and maintenance account remains adequately funded, a portion of race earnings is allocated to replenish the reserve account as needed.

In the event that the reserve account is depleted, our parent company, Experiential Squared (E2), may provide a loan to cover expenses. Any funds loaned by E2 will be repaid using future purse earnings or sales revenue. If, at the time of the horse’s closure, the account remains negative, the outstanding debt will be forgiven.

Additionally, if further funding is required, MyRacehorse has the option to issue additional shares at the prevailing market price. Our goal is to ensure that owners can focus on the experience while we manage the financial aspects of the horse’s care and training.

Yes, Syndicate Shares may offer pass-through taxation benefits, allowing investors to receive direct allocations of gains and losses, potentially avoiding double taxation. Investors will receive a Schedule K-1 for tax reporting purposes.

Syndicate Share investments through MyRacehorse do not qualify an individual for an owner’s license. However, the smaller ownership group provides more opportunities for exclusive access, including paddock visits, winner’s circle celebrations, and behind-the-scenes engagement.

Syndicate Shares allow both accredited and non-accredited investors to participate.

Horse Ownership

Each horse offered through MyRacehorse undergoes a rigorous selection process led by industry professionals, bloodstock agents, and trainers. Our team evaluates key factors such as pedigree, conformation, athletic ability, race potential, and the trainer selected is fit to ensure we select high-quality thoroughbreds. We also work closely with some of the most respected owners and breeders to acquire promising horses with strong racing prospects.

We strive to provide updates every week, but some horses will update more or less frequently. Ultimately, it depends on the horse’s trainer and ownership group.

If you no longer have a copy of your order confirmation email, you can also find this number by going to the account section of our website, then selecting “Orders” to view a detailed history of your past orders with us.

Yes, but you must be accompanied by a MyRacehorse Owner Concierge. Escorted tours are posted in the app, and are a first come first serve basis. Our terms and conditions with the trainers, tracks and partners, require all microshare investors to be accompanied by a MRH Concierge, so you’ll need an escort regardless of whether you have a state owner license or not.

We’ve put together this video that outlines what to expect when seeing your horse in person. It also covers some basic safety protocols to keep you and your horse safe.

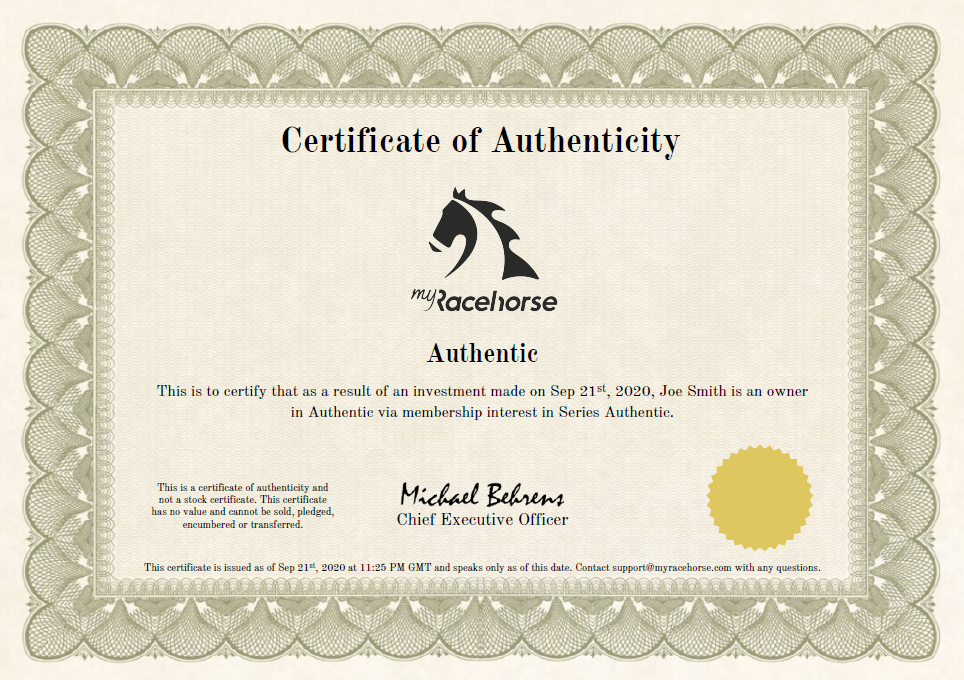

We have a Certificate of Authenticity available for all MyRacehorse owners. This digital certificate can easily be printed from home, and includes the series name, your horse’s name, as well as the date the investment was originally made.

Log into your MyRacehorse account, and select MyHorses from the main menu. Click on the name of the horse you’d like a certificate of ownership for, then click on the COA tab at the top of the page. From there you can follow the prompts to download and print your certificate.

Yes you can. Whenever one of our horses wins, we provide owners a link so they can directly purchase a winner’s circle photo from the track photographer.

For each horse, we have a select number of passes to provide access to the paddock ring prior to the race. We distribute those passes among a horse’s shareholders via a lottery. You may enter for yourself, or yourself and one guest. Each share that you own of a specific horse entitles you to one entry into the lottery. You only need to enter once, our system will count your shares and make the appropriate number of entries. All entrants are notified of the results the evening before the race with the instructions for the winners on how to receive their credentials.

Please keep in mind that horse racing is an unpredictable sport. Therefore, if the horse ends up not racing, the lottery will be voided and a new lottery will be listed once the horse is entered into the new race.

Yes. Tracks have been extremely supportive of MyRacehorse and in more than 90% of our races we have been granted an UNLIMITED number of Winner’s Circle credentials. When you enter a Paddock Lottery, you are automatically being entered into a Winner’s Circle Lottery. In most cases all entrants will be provided Winner’s Circle credentials. In the case that a finite number of credentials are available, winners will be notified the night before.

Whenever a horse races, its purse (minus expenses) will be used to top of the reserve account, which is what we use to pay for ongoing expenses like stables, training, vet bills, etc. If there’s money left over after filling the reserve, the extra will be distributed among shareholders. A detailed breakdown of how a purse is used will be posted in the update section for each race.

Each horse listing will specify the circuit that the Co-Owner intends to race the horse at. Plans can change over time, and it may be necessary to move the horse to another circuit.

The racing manager and the co-ownership group have the decision making authority as outlined in the co-ownership agreement for each horse.

Micro shareholders do not have any say in how the horse is managed. At present, the stakes are minority participants in the larger horse ownership group, and the intent is for the Racing Manager and the Co-Ownership group to make decisions regarding the horse.

Investments made in micro-shares do not make an individual eligible for an owner’s license.

Aftercare

At Myracehorse, we applaud the versatility of the Thoroughbred and their dynamic athleticism and acknowledge that our stewardship extends beyond the confines of the racing circuit, affording us a unique opportunity to champion the welfare and evolution of the Thoroughbred. This includes not only monetary contributions but also strategic partnerships with exceptional organizations/individuals committed to responsibly transitioning racehorses across the country. MyRacehorse aids in the ongoing commitment to the wellbeing of thoroughbreds after racing through the MyRacehorse Transition Fund, which is dedicated to actively participating in the safe transition and long-term placement of retired thoroughbreds. To learn more about the MRH Transition Fund, please click here (https://myracehorse.com/retail-with-a-purpose-2)

The term Aftercare in horse racing refers to the safe transition, placement, and retraining of horses once retiring from the racetrack. Some second career examples include eventing, hunter/jumper disciplines, dressage or trail riding. Depending on what is best for the horse, Aftercare organizations may decide to retire certain racehorses to a relaxing environment to live the rest of life out in the pasture at a loving home. Retired horses previously owned by MyRacehorse have gone on to a second career in jumping, breeding with other award-winning thoroughbreds, or just living a healthy and peaceful life with other animals on a farm.

MyRacehorse supports many accredited aftercare organizations as well as our own retiring runners via the MyRacehorse Transition Fund which is funded through a portion of our share revenue and our Retail with a Purpose initiative. Every year, MyRacehorse makes several donations to Thoroughbred Aftercare Alliance (TAA) accredited organizations such as California Retirement Management Account (CARMA), KyEAC, Second Stride and other various accredited Thoroughbred nonprofit organizations. If you would like to learn more or contribute to the fund directly, please click here (https://myracehorse.com/retail-with-a-purpose-2)

It depends on their age, soundness and prospects for a second career. MyRacehorse has retired several horses after injury and helped place them in new homes where they can relax and live a healthy life in their natural environment.

Tech Support

We’re working on revamping our UI so customers can update their email addresses themselves. In the meantime, you can send an email to support@myracehorse.com requesting an email change and a member of our staff will update it for you.

Payouts are issued to your MyRacehorse Wallet. You can view your wallet balance at any time by visiting the Account section of our app/website. Your wallet balance can be applied to any order placed through MyRacehorse.com, or you can request a wallet withdrawal to have your balance sent to you via check or e-payment.

If your payout hasn’t been issued yet, it’s most likely because your account profile is incomplete. Before we can issue any payouts, we need a SSN, TIN, or EIN on file for any shareholder to make sure we have all the info we need to report those payments to the IRS at the end of the year.

You can update your account with your SSN by going to Account, then selecting Manage Profile. You’ll see a field to add your SSN at the bottom of the page, once you’ve saved that into our records it will appear as a string of seemingly random numbers and letters because we encrypt this information on our servers to protect your privacy. Your payout will automatically be issued within 15 minutes of updating your account.

We are no longer accepting non-US residents. If you’ve set your account up under a company’s name instead of your own, you can enter your EIN into the SSN field instead.

You can reach the MyRacehorse Shop by emailing shopsupport@myracehorse.com.

NOTICES

With regard to communications by MyRacehorse on the Site to gauge interest in a potential Securities offering pursuant to the Regulation A exemption from the registration requirements of the Securities Act, including opportunities to “reserve” Securities as indications of interest in the potential offering, please note (i) that no money or other consideration is being solicited thereby, and if sent in response, will not be accepted, (ii) no sales will be made or commitments to purchase accepted until the offering statement for the potential offering is qualified by the U.S. Securities and Exchange Commission, (iii) any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance is given after the qualification date, and (iv) an indication of interest is non-binding and involves no obligation or commitment of any kind.

All investors using the Site must acknowledge and accept the high risks associated with investing in the Securities. These risks include holding your investment for periods of months or years with limited or no ability to resell and losing your entire investment; you must have the ability to bear a total loss of your investment without a change in your lifestyle. The Site may contain forward looking statements which are not guaranteed. Potential investors should read all of the investment documents that are provided to them. MyRacehorse is not an investment advisor, broker-dealer or crowdfunding portal and does not engage in any activities requiring any such registration. All investors should make their own determination of whether or not to make any investment, based on their own evaluation and analysis. The Securities are being offered and sold only in jurisdictions where such offers and sales are permitted; it is solely your responsibility to comply with the laws and regulations of your jurisdiction of residence. You are strongly advised to consult your legal, tax and financial advisors before investing.

Multiple offerings of Securities may be conducted on this Site. Prior to any investment in any Securities, you should review a copy of the current offering circular relating to those Securities included in the corresponding offering statement filed with the U.S. Securities and Exchange Commission, by visiting the following url: My Racehorse CA LLC CIK#: 000174448